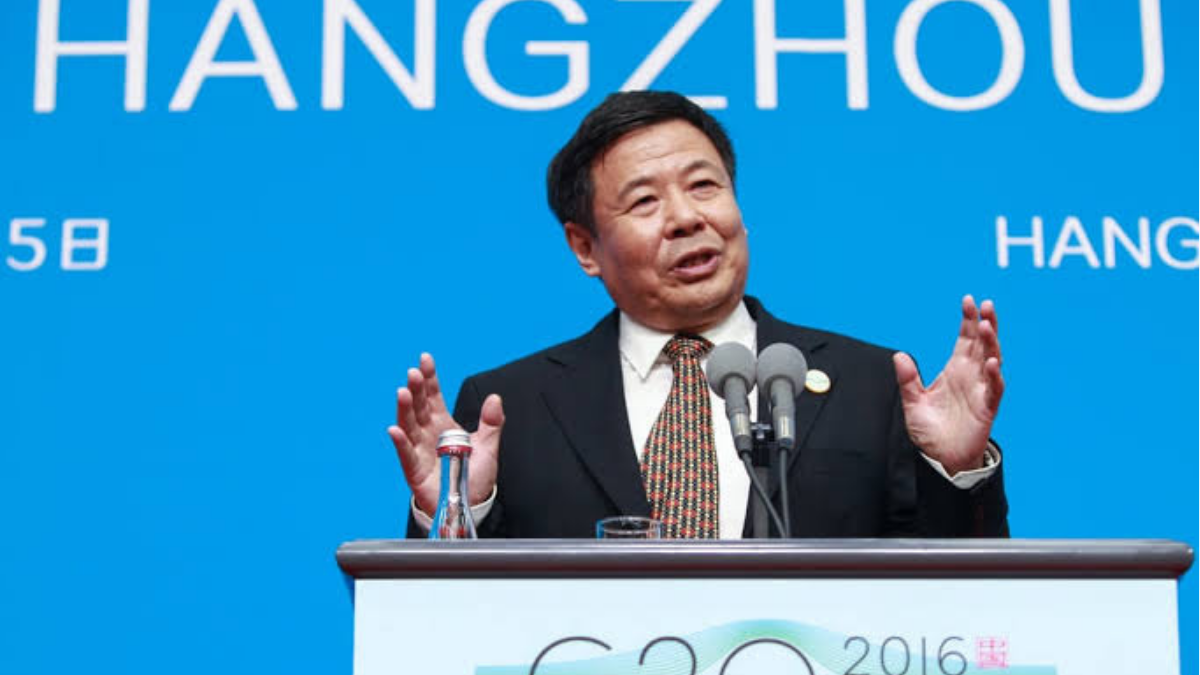

Cryptocurrencies have become more than just digital coins – they are now integral to the future of the global economy. As the U.S. embraces the crypto revolution, China, once a pioneer in blockchain technology, finds itself at a crossroads. A former senior Ministry of Finance official, Zhu Guangyao, recently voiced a pressing need for China to reassess its stance on cryptocurrencies. In a landscape where the U.S. is rapidly advancing its regulatory frameworks and industry integration, Zhu believes that China must take note – or risk being left behind.

“Crypto policy in the U.S. has changed significantly this year, and China should study its impact,” Zhu emphasised, pointing out the rapidly evolving digital economy across the globe. While China has firmly held to its cryptocurrency ban, other nations are seeing unprecedented growth in the sector. With growing conversations around Web3, decentralised finance (DeFi), and blockchain infrastructure, Zhu and a cohort of experts argue that China should reconsider its rigid stance.

A Shift in Global Crypto Policies

Zhu’s comments come on the heels of major changes in U.S. crypto policy, with regulatory bodies like the SEC and CFTC slowly but surely working towards a comprehensive framework for digital assets. The U.S. government, though cautious, has stated that it sees crypto not just as a financial tool but as a means to enhance economic competitiveness. Cryptocurrencies are moving beyond speculation, and Zhu is among the voices urging China to recognize the growing momentum in the West.

“The U.S. is embracing this industry,” Zhu stated. “And we must not ignore its impact. If China lags too far behind, the cost of catching up may be too high.”

Zhu is not alone in this belief. While China has spent years honing its digital yuan, the world’s first major central bank digital currency (CBDC), the rapid advancements in crypto technology elsewhere have raised concerns that focusing solely on the digital yuan could limit China’s role in the broader digital ecosystem.

Is China’s Ban a Double-Edged Sword?

China has taken a hardline approach to cryptocurrencies since 2021, when it banned all crypto transactions and activities, driving crypto miners and businesses abroad. At the time, the People’s Bank of China (PBOC) cited concerns over financial stability and capital outflows, preferring to concentrate on its tightly controlled CBDC, the digital yuan. This move aligned with China’s desire to keep a strong grip on monetary policy, ensuring that digital assets couldn’t undermine its centralised financial system.

However, Zhu and others believe that the blanket ban, while providing short-term stability, could ultimately stifle innovation. “We mustn’t forget that blockchain, the technology underpinning cryptocurrency, was once something China led the way in,” Zhu remarked. He added that with major players like the U.S. and the European Union continuing to integrate digital currencies into their economies, China could miss out on key advancements in decentralised finance.

Reassessing the Global Impact

Cryptocurrencies are no longer just an investment vehicle. They are foundational to innovations like smart contracts, DeFi, and digital identities. Zhu’s key concern is that China risks being isolated from these advancements if it maintains its current course. He pointed to the U.S. as an example of a nation taking a more nuanced approach, balancing regulation with fostering innovation.

“The U.S. is no longer just cautiously watching – it’s becoming an active player. China should examine this shift and understand how these policies can reshape the global digital economy,” Zhu said.

While the digital yuan offers some advantages in cross-border payments and financial inclusion, Zhu and his peers argue that China’s approach must expand to cover the broader applications of cryptocurrency and blockchain. The fear is that as more countries adopt and integrate decentralised technologies, China will be left out of important discussions that will shape the future of digital finance.

As calls for a policy review grow louder, the question remains: Will China adapt its crypto policy to keep pace with the rest of the world? For now, the nation’s focus remains on the digital yuan, with no indication of reversing its ban on private cryptocurrencies. But voices like Zhu’s reflect a growing recognition that ignoring crypto could ultimately cost China its place as a leader in financial innovation.

“The digital economy is here, and cryptocurrency is a critical part of it. We must engage with it, or we risk being left behind,” Zhu concluded.

China, with its deep investment in digital transformation, still holds the power to influence the future of global crypto development. The question is: will it seize that opportunity, or let it slip away as others move forward?

Leave feedback about this