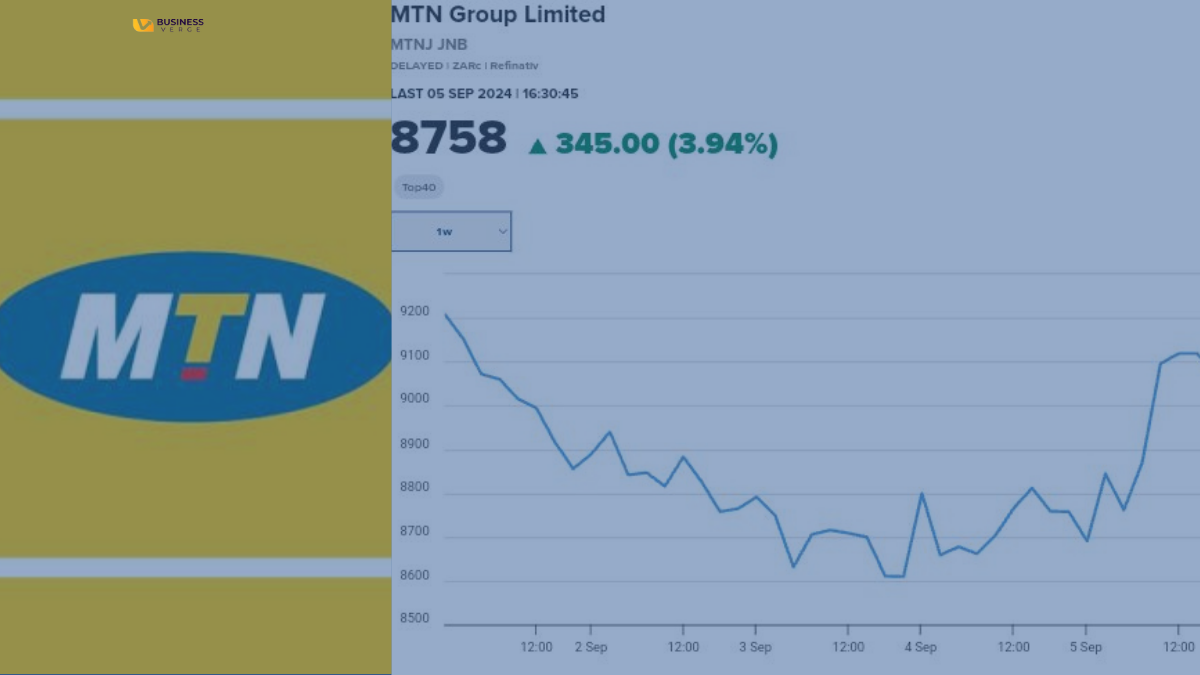

MTN Group (JSE: MTNJ) has once again proven its resilience in the telecom market with an impressive 3.94% rise in its stock price, closing at 8758 ZAR on the Johannesburg Stock Exchange. With over 4.68 million shares traded on September 5th, MTN continues to capture the attention of both institutional and retail investors. But what’s driving this surge, and what should investors be watching?

Key Metrics for September 5

Closing Price: 8758 ZAR

Price Change: +345 ZAR (+3.94%)

Trading Volume: 4.69 million shares

In-Depth Analysis of September 5 Performance

On September 5, MTN Group’s stock exhibited a significant upward movement, closing at 8758 ZAR, marking a robust 3.94% increase from the previous trading session. This detailed analysis breaks down the key factors contributing to this performance and provides a comprehensive view of the stock’s behavior.

Daily Price Movement and Volume

• Opening Price: The stock opened at 8413 ZAR, which was a reflection of recent trading sentiment and market conditions.

• High of the Day: MTN’s stock reached an intraday high of 8800 ZAR, reflecting strong buying pressure and optimism among investors.

• Low of the Day: The stock’s low for the day was 8400 ZAR, indicating that while there was volatility, the stock found support at this level.

• Closing Price: It closed at 8758 ZAR, showing a net gain of 345 ZAR or 3.94%. This closing price represents a significant recovery and an affirmation of investor confidence.

The trading volume of 4.69 million shares indicates a high level of market activity. Increased trading volume often signifies robust investor engagement and can validate the strength of the price movement. In MTN’s case, this volume suggests that the day’s price increase was supported by broad market participation, rather than isolated trades.

MTN’s financial strategy has been a major focus for investors. As one MTN investor commented, “Achieving revenue growth while managing costs remains critically important. Telcos are capital-intensive, and therefore it is important to balance capex against operating cash flow.” MTN has worked diligently to reduce its dollar-denominated debt while monetizing assets to unlock more value for shareholders. This balance between capital expenditure (capex) and cash flow has strengthened its position in the market.

MTN’s recent performance has prompted positive reviews from market analysts. Several have maintained a “buy” rating, citing the company’s continued focus on growth sectors like fintech and digital services. Current price targets range between 9000 and 9500 ZAR, which points MTN Group’s Stock Surges 3.94% on JSE further upside potential.

The company’s dividend yield remains attractive, further adding to its appeal for income-focused investors. MTN’s ability to maintain regular dividend payouts despite capital expenditures shows its strong financial health, making it a solid pick for both growth and income investors.

Leave feedback about this